hard money lenders in Atlanta Georgia for Property Investors

hard money lenders in Atlanta Georgia for Property Investors

Blog Article

Understanding the Basics of a Hard Money Finance: Your Comprehensive Overview

Browsing the world of actual estate financing can be complex, especially when it concerns hard Money lendings. As an alternative type of funding, these fundings play a critical function in property financial investment methods, yet they stay shrouded in secret for lots of. This detailed guide seeks to demystify the idea and procedure of hard Money finances, using possible borrowers a thorough check into their advantages and drawbacks. Let's start this journey to obtain higher economic proficiency.

What Is a Hard Money Funding?

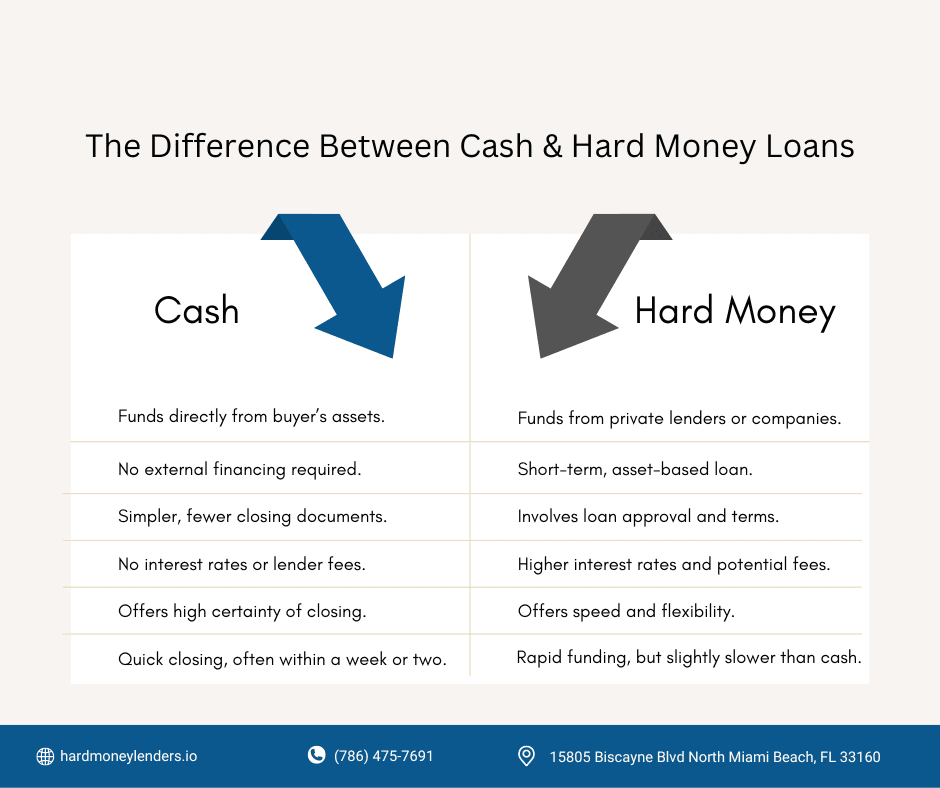

a Hard Money Financing, typically viewed as a monetary lifeline, is a specific kind of asset-based funding. It is usually issued by private capitalists or firms as short-term loans based on the building's value rather than the debtor's credit reliability. The allure of this Loan rests on its rate of problem, bypassing the extensive authorization process of conventional financings.

Exactly how Does a Hard Money Funding Job?

Ever asked yourself just how a Hard Money Finance functions? Basically, it's a temporary Funding, generally made use of in genuine estate deals, secured by the residential property itself. This kind of Loan is primarily made use of by capitalists looking for quick financing without the rigid demands of traditional banks.

In a Hard Money Loan, the consumer receives funds based on the worth of the residential property, not their creditworthiness. The loan provider, typically an exclusive individual or firm, evaluates the building's value and lends accordingly. The process is quicker than traditional fundings, often finished within days.

Nevertheless, tough Money financings come with greater rate of interest and charges due to the enhanced risk. When the consumer can not qualify for various other funding alternatives., they are generally made use of for fix-and-flip jobs or.

Comparing Hard Money Car Loans and Conventional Finances

While difficult Money car loans and standard lendings both act as financing options, they differ substantially in various elements. Traditional financings, usually provided by financial institutions or lending institution, usually have lower rate of interest and longer-term settlement timetables. They call for extensive credit scores checks and proof of earnings, which can lead to a prolonged approval procedure.

On the various other hand, hard Money fundings are normally issued by exclusive capitalists or business. The security for the Loan is usually the residential property being purchased. This sort of Lending is characterized by temporary Financing browse around these guys durations and higher rate of interest rates. The authorization process is commonly faster, as it relies less on the debtor's creditworthiness and even more on the worth of the hidden asset.

Benefits and Disadvantages of Hard Money Fundings

Despite their higher rate of interest, difficult Money finances offer numerous significant benefits. Mostly, they are quicker to procedure than typical fundings, which can be essential for time-sensitive investment possibilities. hard money lenders in atlanta georgia. These fundings are normally based upon the residential or commercial property's worth as opposed to the consumer's creditworthiness, making them an eye-catching option for those with poor credit history or that need a swing loan

Nonetheless, the disadvantages of difficult Money financings must not be ignored. The previously mentioned high interest rates can make these financings cost-prohibitive for some borrowers.

Leveraging Tough Money Lendings genuine Estate Investments

Conclusion

Tough Money financings, while pricey, offer a viable solution for those seeking quick, short-term financing for actual estate procurements and remodellings. Comprehending the basics of difficult Money lendings is critical for any kind of possible actual estate financier.

The charm of this Loan relaxes on its speed of issue, bypassing the lengthy approval process of conventional fundings. Comparing Tough Money Finances and Standard Financings

Unlike traditional finances, hard Money car loans are not largely based on the consumer's creditworthiness but on the worth look at here now of the property being bought. hard money lenders in atlanta georgia.

Report this page